India Post Payment Bank (IPPB) Customer Care number is 155299 for phone banking and 1800 8899 860 for emergency. Other customer care and complaint numbers are:

- Phone Banking Number: 155299

- Unauthorized Transaction, Debit Card Block: 18008899860

- SMS Banking Number: 7738062873

- Missed Call Banking: 8424046556 and 8424026886

- Email: contact@ippbonline.in

The office address for physical mails is:

India Post Payments Bank Ltd.,

Corporate Office, 2nd Floor,

Speed Post Centre,

Bhai Veer Singh Marg,

Market Road, New Delhi-110001.

Table of Contents

Different Calling Facilities with India Post Payment Bank

1. Phone Banking

Phone banking number for India Post Payment Banks is 155299. However, you need an account with IPPB to access the facilities on this number.

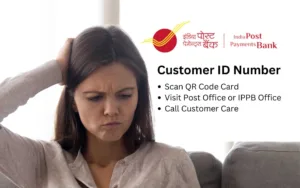

Also Read: How to Know India Post Payment Bank(IPPB) Customer ID?

IPPB Phone Banking Facilities:

- Account Information

- Answers to Personal Queries

- IPPB Products and Services information

- Last 5 transactions

- Doorstep Banking (for 60+ as per my last contact with them)

- Account Statement

2. SMS Banking

You can use SMS for knowing balance and getting a mini statement. However you need to register first by sending “REGISTER” to 7738062873.

- Balance Enquiry : Send BAL to 7738062873

- Mini Statement : Send MINI to 7738062873

3. Missed Call Banking

If you have your number registered at India Post Payment Bank, you can give missed calls on the following two numbers for balance enquiry and mini statement.

- Balance Enquiry Number for Missed Call Banking: 8424046556

- Mini Statement Number for Missed Call Banking: 8424026886

Source: IPPB

How to Register Mobile Number in India Post Payments Bank (IPPB)

It is very easy to register your mobile number with India Post Payment Bank.

- Visit any nearest post office with PAN and AADHAR original cards.

- Ask IPPB officer (usually a Postman or Clerk) to open an account.

- Fill the details and note down the following things very carefully.

- Account Number

- CIF Number

- PIN

- Password

- Security Questions and Answers

- After that link your IPPB account with DOP Savings Account.

About India Post Payments Bank

India Post Payment Bank was started by India Post on 30 January 2017 to modernize the financial services offered by India Post.

My Experience with India Post Payment Bank

IPPB officer helped me get back my ₹6,000 which I lost due to faulty transaction.

I have observed that major post office in India which is in a town has a person whether a postman or a clerk as an IPPB officer.

I have been using the India Post Payments Bank account since 2020 and have always found them approachable and helpful. Earlier the IPPB officer in my hometown was so helpful that we ended up becoming friends.

Frequently Asked Questions

What is DOP Savings Account?

DOP Savings Account is the account you have opened at a post office, it typically comes with a red passbook. DOP stands for Department of Posts.

How many transactions in IPPB Mini Statement?

IPPB Mini Statement has your last 5 or 10 transactions.

[…] List of All India Post Payment Bank (IPPB) Customer Care Numbers […]